Everyone loves a good gift! And how great does it feel when you choose a gift for someone knowing its thoughtful and the perfect match for them?

Don’t wait until the holiday season to do all your gifting. Think of other times through out the year where gifting might be appropriate for your industry. Or better yet, give a gift at an unexpected time to really surprise and delight your recipient.

Perhaps work place anniversaries, when a staff member or client has gone above and beyond, to celebrate long service or at the end of financial year.

DON’T LOSE THE BALANCE OF YOUR MARKETING BUDGET!

What better way to spend than to invest in some gifts for your clients and staff. We can provide gifts with products that have a long shelf life or are non-perishable, so you can buy up now and have some gifts on hand ready for the perfect gifting moments.

THE IMPACT OF GIFTS IN BUSINESS

Gift giving can be a great way of becoming memorable with your clients and building some good will and loyalty. When a client receives a memorable gift, they are more likely to recommend your business to others and be a repeat client (Forbes.com).

In the workplace, gift giving can be a great morale booster and relationship builder. Gifts are also awesome for generating efficient and happy staff.

According to Instantprint’s employee survey, 94% of employees claim that a gift from their employer makes them feel valued, appreciated and improves staff workplace satisfaction. While 69% of employees suggested they would work harder if they felt their efforts were appreciated (TINYPulse)

Impact Nation reiterates this by suggesting that 57% of staff would remain with a company that implement staff gifting programs, increasing staff engagement and improving staff retention.

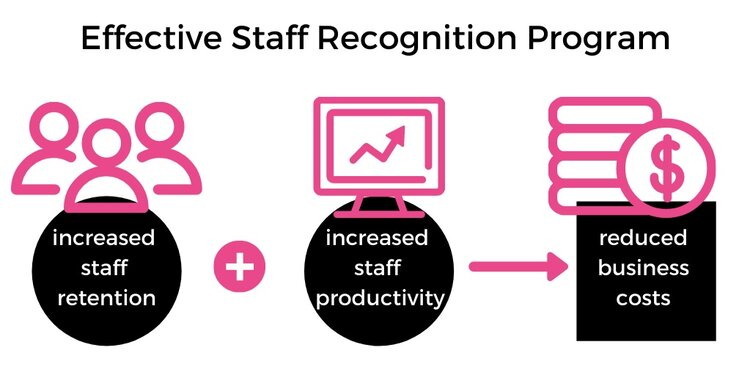

Staff turnover can be an expensive exercise with the costs of ads, interviews, recruitment and training. Imagine saving all that time and money AS WELL AS retaining loyal staff, by simply implementing an effective recognition program. It is reported that businesses adopting an effective recognition program, enjoy 31% lower staff turnover rates (socialcast).

Along with reduced turnover, these businesses also typically witness increased staff productivity. A result many businesses strive for!

ARE WORKPLACE GIFTS TAX DEDUCTIBLE?

While it would be wonderful to never have to think about the costs of gifts, that’s just not the way the world works! Thankfully, gift giving from businesses can be a tax deduction. But don’t take our word for it! Our Australian tax guru and small business specialist accountant, Tim Fanous from Fanous Business Tax Advisory says,

Hampers or branded merchandise is an ideal gift for clients as this type of outgoing is not classified as “Entertainment” which isn’t tax deductible.

The Australian Tax Office (ATO) Ruling under Section 8-1 of the ITAA 1997 entitles business owners to claim a tax deduction for gifts made to a former or current client if the gift is characterised as being made for the purpose of producing future assessable income.

The ATO provides these examples to explain:

Example 1

Sally is carrying on a renovation business. Sally gifts a bottle of champagne to a client who had a renovation completed within the preceding 12 months.

Sally expects the gift will either generate future business from the client or make them more inclined to refer others to her business. Although Sally got on well with her client, the gift was not made for personal reasons and is not of a private or domestic character.

Further, the outgoing Sally incurred for the champagne is not of a capital nature.

Therefore, Sally is entitled to a deduction under section 8-1 of the ITAA 1997.

Example 2

Bernard is carrying on a business of selling garden statues. Bernard sells a statue to his brother for $200. Subsequently, Bernard gifts a bottle of champagne to his brother worth $170. Apart from his transaction, Bernard provides gifts only to clients that had spent over $2,500 over the last year.

The gift has been made for personal reasons, and is of a private or domestic character.

Therefore, Bernard is not entitled to a deduction under sections 8-1 or 40-880 of the ITAA 1997.

The ATO is clear that gifts of “Entertainment” such as food, drink or recreation and also providing accommodation or travel in connection with such entertainment isn’t tax deductible unless in limited circumstances. Recreational activities include amusement, sport and similar activities like theatre or movie tickets, a cruise, game of golf etc.

If hampers or branded merchandise is provided to employees and their families, the gift is tax deductible & GST can be claimed if it is:

- A one-off gift, defined as ‘infrequent’

- Not classed as entertainment

- Under $300 (GST inclusive)

If you are not sure about the deductibility, reach out to us before committing to purchasing gifts for clients or employees and we can determine what can be claimed as a tax deduction.

For more tax time tips, you can connect with Tim here:

Web: https://fanousbta.com.au/

Email: tim.fanous@fanousbta.com.au

Fb: https://www.facebook.com/FanousBTA

Phone: 1800 I DO TAX

WHAT NEXT?

If you like what you’ve read here and want to make an impact on your clients and/or staff by surprising them with a gift, visit www.giftlinx.com.au for some great staff and client gift ideas.

We are more than happy to discuss your gifting needs to make sure we can put together something you are really proud to give that represents you and your brand.

We can certainly create memorable gifts that make you stand out and fit within the regulations of tax deductible gifting*.

Remember, we can always customise, brand and match the perfect gift to your business, industry and budget.

Get in quickly to spend this financial years budget – you only have a few short weeks left!

To discuss your gifting needs, contact us now!

References:

- https://www.smallbusiness.wa.gov.au/blog/claiming-tax-deductions-client-gifts

- Taxation Determination TD 2016/14

*Gift Linx are a gifting service and do not provide tax advice. Please consult with your tax agent or Tim Fanous to ensure you have correct information for your tax deductible gifting needs.