Government Rebate

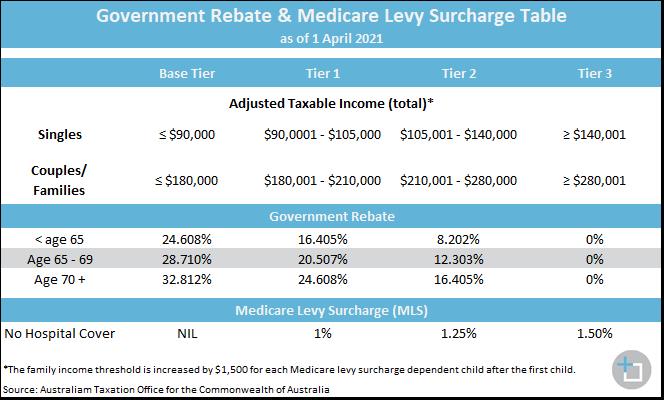

To make private health insurance more affordable, most Australians currently receive a rebate from the Australian Government to help cover the cost of their premiums. The rebate is age and income tested based on your ‘adjusted’ taxable income. See table for the government rebate rates.

Medicare Levy Surcharge (MLS)

The MLS is an additional levy of up to 1.5% for individuals & families who don’t have private hospital cover and their ‘adjusted’ taxable income is over a certain amount. This levy is on top of the standard 2% Medicare levy which is in place to encourage individuals to take out insurance. See table for the MLS rates.

- TIP 1 – Notify private health provider each year of your ‘adjusted’ taxable income to ensure the correct Government rebate is applied to the policy. Note, over claimed rebates are paid back in the tax return.

- TIP 2 – Ensure all dependants are included on the policy to avoid the MLS. Watch out for first time parents!

- TIP 3 – If you don’t have hospital cover by 1 July following your 31st birthday and choose to take it out later in life, a loading of 2% will be added to your hospital cover premium for each year you were aged over 30 without it.

- TIP 4 – If you are planning to change to another insurance company, consider waiting times on the new policy.